FOR IMMEDIATE RELEASE

SBA Reports Surge in Charge-Offs for Covid-Era EIDL Loans in FY 2023

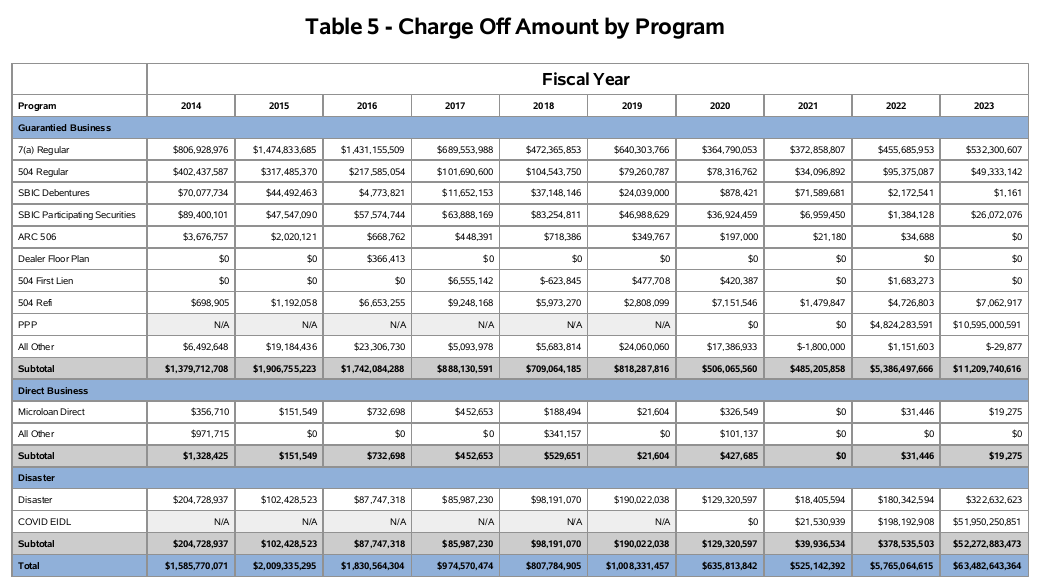

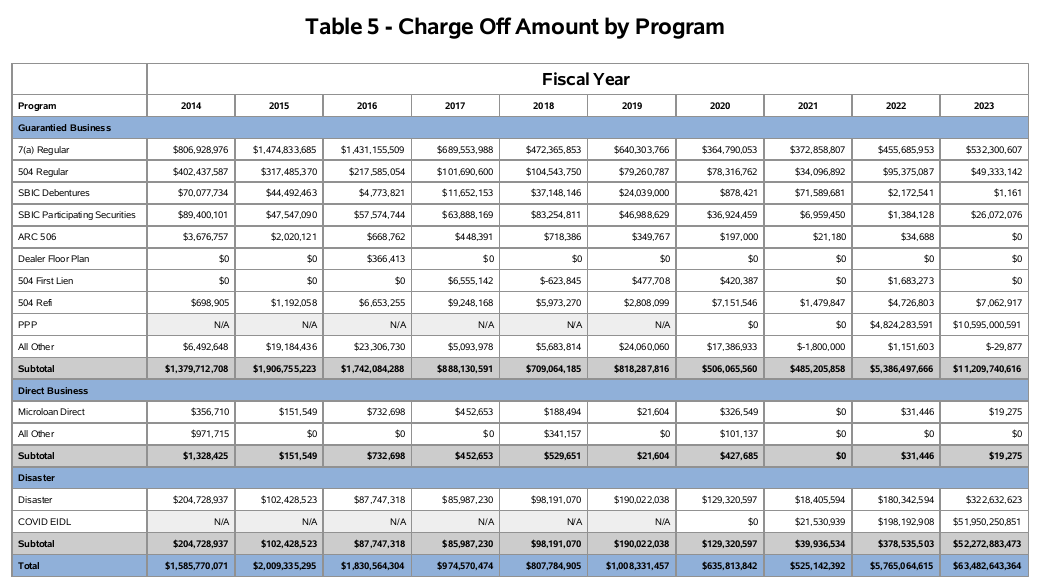

Nationwide – February 6, 2024 (USANews.com) – In a notable fiscal update, the Small Business Administration (SBA) has reported a significant increase in charge-offs for Covid-era Economic Injury Disaster Loan (EIDL) program loans in Fiscal Year 2023. The total charge-offs amounted to an astonishing $52 billion, marking a drastic rise from the combined total of $220 million in FY 2021 and 2022.

This increase represents 17.2% of the unpaid principal balance of these loans, which is particularly significant considering the lengthy average term of approximately 28 years remaining on these loans. The FY 2023 charge-offs are not inclusive of loans charged off in the last quarter of the year, as the SBA’s fiscal year concluded on September 30, 2023.

The SBA’s criteria for charge-offs include situations where it is determined that no additional principal and interest can be recovered from the borrower. As of the end of FY 2023, the remaining unpaid principal balance on Covid-era EIDL loans stands at $302 billion, down from $358 billion the previous year. This reduction in balance is largely attributed to these charge-offs rather than principal repayments by borrowers.

In addition to the EIDL loan charge-offs, the SBA also reported an increase in charge-offs for Paycheck Protection Program (PPP) loans. In FY 2023, PPP loan charge-offs totaled $10.6 billion, a significant increase from $4.8 billion in FY 2022.

The SBA released this information as part of its regular fiscal year reporting on February 2, providing crucial insights into the ongoing impact of the Covid-19 pandemic on small businesses and the federal response to aid recovery.

For more information or inquiries about these developments and how they might affect your business, please contact:

Contact: Daniel Dias

###

SBA Reports Surge in Charge-Offs for Covid-Era EIDL Loans in FY 2023

Nationwide – February 6, 2024 (USANews.com) – In a notable fiscal update, the Small Business Administration (SBA) has reported a significant increase in charge-offs for Covid-era Economic Injury Disaster Loan (EIDL) program loans in Fiscal Year 2023. The total charge-offs amounted to an astonishing $52 billion, marking a drastic rise from the combined total of $220 million in FY 2021 and 2022.

This increase represents 17.2% of the unpaid principal balance of these loans, which is particularly significant considering the lengthy average term of approximately 28 years remaining on these loans. The FY 2023 charge-offs are not inclusive of loans charged off in the last quarter of the year, as the SBA’s fiscal year concluded on September 30, 2023.

The SBA’s criteria for charge-offs include situations where it is determined that no additional principal and interest can be recovered from the borrower. As of the end of FY 2023, the remaining unpaid principal balance on Covid-era EIDL loans stands at $302 billion, down from $358 billion the previous year. This reduction in balance is largely attributed to these charge-offs rather than principal repayments by borrowers.

In addition to the EIDL loan charge-offs, the SBA also reported an increase in charge-offs for Paycheck Protection Program (PPP) loans. In FY 2023, PPP loan charge-offs totaled $10.6 billion, a significant increase from $4.8 billion in FY 2022.

The SBA released this information as part of its regular fiscal year reporting on February 2, providing crucial insights into the ongoing impact of the Covid-19 pandemic on small businesses and the federal response to aid recovery.

For more information or inquiries about these developments and how they might affect your business, please contact:

Contact: Daniel Dias

Small Business Lending Source

888-885-1907

[email protected]

About Small Business Lending Source: Small Business Lending Source is a leading financial services company dedicated to supporting the growth and development of small businesses. With several years of experience, we have been providing a range of financial solutions including SBA loans, term loans, credit lines, and equipment financing to various small businesses, helping them achieve their financial goals and expand their operations. Our team of experts is committed to delivering exceptional service and results, ensuring the success and satisfaction of our clients.

About Small Business Lending Source: Small Business Lending Source is a leading financial services company dedicated to supporting the growth and development of small businesses. With several years of experience, we have been providing a range of financial solutions including SBA loans, term loans, credit lines, and equipment financing to various small businesses, helping them achieve their financial goals and expand their operations. Our team of experts is committed to delivering exceptional service and results, ensuring the success and satisfaction of our clients.

.png?alt=media&token=e3d8feda-194a-4266-a7fe-d9c9692fc907)